With rental yields here in Melbourne the lowest in any capital city around Australia, the question is, is it still a good investment market? In my mind, it’s a yes. The capital growth over the past 5 years has been amazing, and some investors who purchased in 2012 have seen their properties increase in value by up to 80%.

What property investment strategy should I consider?

The strategy when looking to purchase an investment property comes down to the individual and their goals. For example, if I was talking to a young person in their 20’s or 30’s then I would always be recommending buying for capital growth. Whether it’s their first or second investment property, capital growth should always be the focus, as equity in property will allow them to do more in the future.

One example of when rental income may be the key driver is when someone is considering their retirement and wanting cash flow. They may have plenty of equity already and won’t have debt against the asset.

Not all properties are created equal, and houses with land have seen significant growth in value over the last five years. However, apartment values have stalled in growth in certain “blue-chip” suburbs, as there has been a massive influx of development, resulting in more supply for potential apartment buyers.

I personally purchased an apartment in Ivanhoe in 2009, if I purchased a house in the neighbouring suburbs a little further out Preston, Reservoir, Bellfield or Heidelberg, I probably would have doubled my money by now. Hindsight is a great thing though!

Let’s compare rental income vs capital growth

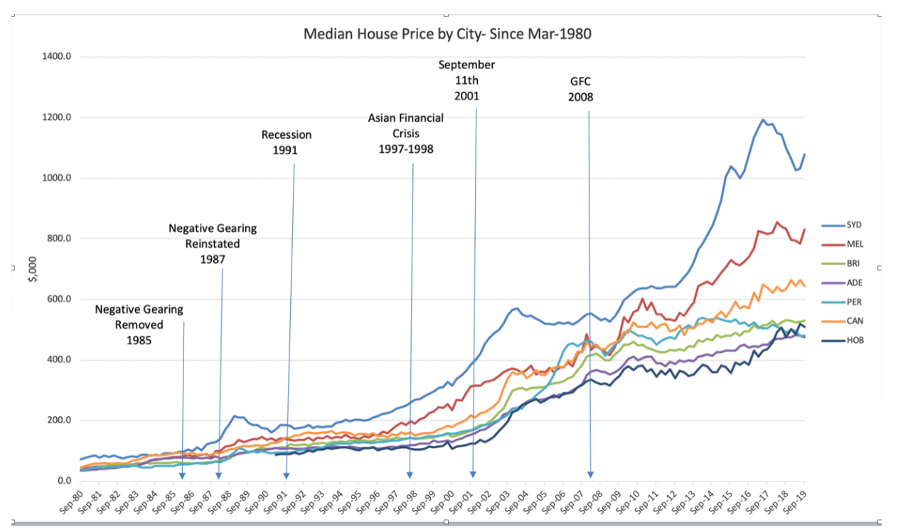

As you can see from the above graph (based on a property purchased for $500,000), the compound effect of capital growth will be $100,000’s of dollars extra in your pocket if you purchase the right house in the right area and properties continue to appreciate at the current rate.

Rental guarantees sound good on paper but be very wary of these. Normally it’s a developer trying to move their stock and guaranteeing a high rental return as an incentive to buy the property. The problem with this is, normally the rent is inflated and when the time runs out, you will be get less on the open market.

Some of the highest performing capital growth properties over the past 5 years have had shocking rental yields. Reason being, they have been older style houses on big blocks of land in up and coming suburbs.

Finding the unicorn

Does the property exist where you can get both high rental yield and strong capital growth??? I call this property the unicorn as if they do exist, no one ever sees them. The best example I can think of that I have seen in recent times is a client of mine called Aydin, who purchased a single fronted property in Clifton Hill in May 2015 for $873,000.

Aydin didn’t touch the property and rented it out on Air BnB for around $40,000 per annum. This is a good rental return of 4.5% based on his purchase price. However, the kicker on this property was we did a bank valuation 18 months later which came in at $1,175,000, representing a whopping 22% growth in that time. It certainly would have kicked on a bit more this year and I’d expect it to be worth $1,300,000 – $1,400,000 if it sold at auction today.

If you can grab something like this where you are getting 15% capital growth and above 4% rental yield, then you have done very well.

For advice on your own investment strategy, feel free to speak to us about professional help from one of our buyers advocate partners.

By Damien Roylance.

Image credit Gramercy Armadale by Roulston.