Vincent continues his tips for securing a healthy financial future

In the last article, I started to paint the picture on how best to prepare for a home loan as we looked into living expenses and savings. This week, the fun continues as I’ll explain some of the other pitfalls that can lead to a PFC, and of course, how to avoid them.

CCR / Credit Enquiries

CCR stands for Comprehensive Credit Reporting. Our worst fears have been realised (not really) as banks are now communicating with each other to share your personal information on credit cards, personal loans and repayments. For example, you might have banked with CBA your whole life (starting with Dollarmites as everyone does), but decide to apply through NAB for your first home loan due to an amazing they have offered you.

When you apply for your home loan, CBA will share all of your repayment information and debt limits to NAB. That means if you went over your credit card limit back in December in order to keep your gifting game strong, NAB will now have access to that. In the past, what you did with one lender wouldn’t be passed onto another.

Our recommendation: It’s much of the same as the previous recommendations and it involves staying on top of your repayments and managing your money well. If you’re on top of your living expenses and savings, then you shouldn’t have any issues. If not, then banks will find out that you’ve been missing repayments and start asking more questions, potentially impacting your chances of getting finance.

Afterpay

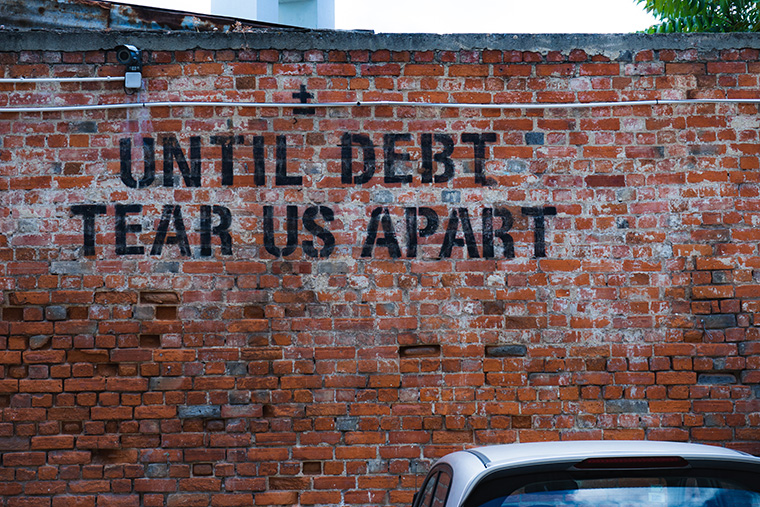

We really don’t like this one. Described by Scott Pape as the ‘marijuana of credit’, it’s a softer way to encourage you to get into debt. You’ll get to purchase something you want now and won’t have to pay for it straight away without paying any interest. Instead, you can make four easy repayments in the upcoming weeks.

One small hit never hurts… does it? This is a slippery slope into credit cards and mountains of debt. It starts with a moment of weakness and a puff of Afterpay and ends in a dark room shivering from all the credit card and personal loan debt. Lenders don’t like it either as it shows poor money management when you need to borrow money to buy a pair of shoes.

Our recommendation: Give this bad boy a wide berth. It’s not a good sign of money management and it can only lead to future issues. If you really want those shoes, wait two weeks until you can afford them.

Drugs/Gambling/Other expenses

If lenders get a whiff of any transactions related to drugs, excessive gambling or something else that will be considered of poor character – this could lead to a decline on your application. No matter how safe the bet is (Winx anyone?), the banks won’t like knowing that the small innocent habit of yours could potentially escalate into one that will stop you paying your home loan.

Our recommendation: Close the betting account and start putting that money towards savings. It’s almost guaranteed to give you better returns in the long run.

Summary:

How you manage your money and debt is going to impact your future borrowing like never before. Get on top of your money early, start a plan and get some savings in the bank. Otherwise, you’ll end up with a blank canvas and no way of ever buying that perfect property.

Vincent Moore’s tips were first published on his LinkedIn page. To speak to Vincent about your property goals, schedule a call.