A normal market doesn’t sell papers

5 min read

How much of the hype published in papers and online should you believe? It’s easy to get caught up in the news cycle, clicking on sensational articles. From unaffordable house prices to a housing market crash, economic doom and gloom to out of control inflation – this year we’ve seen it all.

But if we take a step back and look at what’s actually happening (backed by published data from reputable sources) what do we really see?

For the week ending July 24, 2022, Melbourne saw a 66% clearance rate with 440 auctions scheduled. Overall, in Victoria there were 292 properties sold at auction worth $292M and 177 private sales worth $142M. The current RBA cash rate is 1.35%. We are in the midst of a drop in dwelling values, after a cyclical peak in February 2022.

The auction clearance result in the first week of July, 2019 was 68%, there were 338 auctions scheduled with 237 auctions reported and 170 sold at auction worth $122M. The RBA cash rate at the time was 1.00%. July 2019 was the beginning of a cyclical uptick, which peaked in November 2019.

Here’s a handy table to compare them side by side:

| Auction clearance rate | Median house price | Median unit price | RBA cash rate | |

| July 2019 | 68% (237 auctions) | $818K | $501K | 1.00% |

| July 2022 | 66% (292 auctions) | $1.08M | $671K | 1.35% |

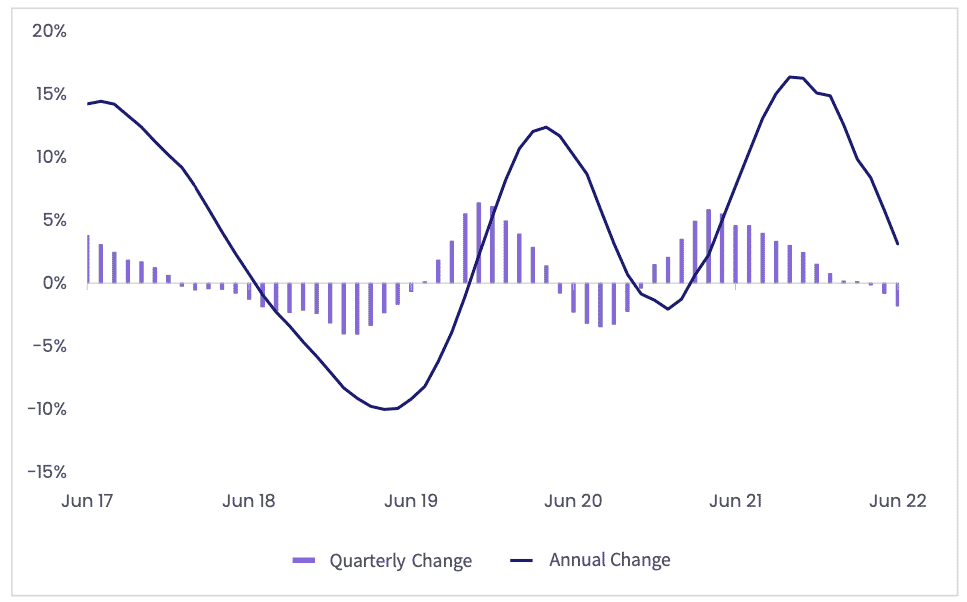

If we take a birds eye view, we can see the Melbourne market operates in cycles. Here’s what Melbourne’s property market has looked like over the past few years:

Source: Core Logic

That’s a lot to digest, but the major point being 2019 and 2022 were very, very similar in terms of the numbers. The biggest difference between the two comes down to the median house and unit prices, which have gone up substantially over the past three years. Critically, this means the average property owner has more equity than they did in 2019 due to market movement.

2019 was considered a very normal year for the property market. There was no talk of crashes or bubbles, just the beginning of a growth cycle with sufficient stock on the market. And the point is this. We are in a very normal market right now too. But normal markets don’t sell papers (or serve as very good clickbait).

Certainly, there are many external factors at play which the media pick up on. People are increasingly concerned about interest rate rises and the cost of living. However, for many, if the media weren’t sensationalising constantly throughout the day across a range of channels, they probably wouldn’t have noticed a dramatic change in their day-to-day expenses and overall financial wellbeing.

The RBA believes households will remain resilient in the face of interest rate rises. Since the beginning of the pandemic, households saved an additional $260billion with a share of these funds funnelled into offset and redraw facilities on home loans. Looking at aggregate household balance sheets, most households hold assets more than 1,000% of their disposable income, with housing underpinning a substantial chunk of this wealth. In comparison, household debt sits at less than 250% of disposable income.

The key takeaway is this. Despite what you may read in the media, we are operating in a normal property market. Many households experiencing high asset growth (particularly in housing) with access to liquidity and low debt to asset levels.

Don’t believe everything you read in the paper and most of all, before deciding about buying or selling property, get in touch with a team of experienced Vendors Advocates based in the Richmond (Cremorne) area who understand the market and can inform your decision making.