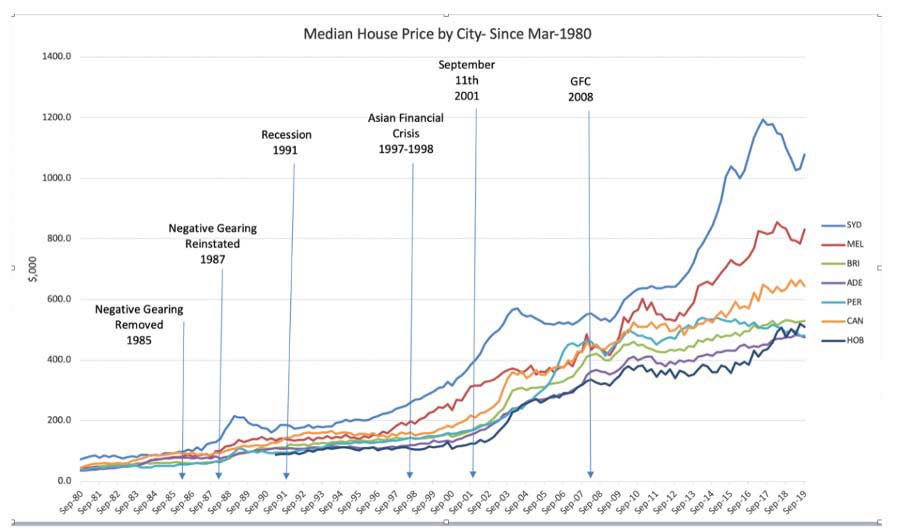

We’ve been watching property prices rise as though attached to a yoyo for the last 40 years (see below graph – note this does not include the recent year 2020 as we are yet to see the full impact of COVID on the property market). Despite market crashes (or corrections as they’re sometimes called) over the years, we continue to see a clear upward trend. Melbourne and Sydney have seen the largest increase in median price over the years, increase in excess of 1000% and 800% respectively. It should be noted, these are just the median prices – growth in different parts of the market has far exceeded these impressive figures.

Certain pockets of Melbourne have seen 1300% growth, such as Armadale, Toorak and Brighton. Properties purchased for $100,000 back in 1992 are now valued at around $1,300,000 – these a just little weatherboard homes too, we’re not talking the big mansions by the beach.

Can we sustainably maintain this growth?

A question we ask is this, will be see a compression of this growth? Not whether values will decline, but whether they can continue to grow at the current rates. Have we seen far too many impacting global events this decade and exponentially higher property taxes to allow for properties to double in value every seven to ten years?

Now may not be the best time to be asking this question. People are hurting, jobs have been lost, we’re starting down the barrel of some hard years ahead after these lockdowns have ended. The Financial Review has just reported a trebling in Sydney of the number of vendors reducing their prices (14.7% in June 2020) and Melbourne has seen four times the discount rate compared with 2019 (11.5% in June 2020).

But it’s a volatile time and you can’t necessarily look at this moment in time and apply it to the market over the next twenty years.

Wage growth and debt-to-income ratio

There are some factors that will impact our ability to afford property if it continues to grow at a rapid pace. This includes wage growth which has been declining since 2011, limits to the amount of debt as a proportion of income you earn that lenders will allow you to borrow. Many lenders are introducing restrictions so that your total debt, doesn’t exceed more than six or seven times your gross income. If housing prices grow at their current rate and wages don’t follow suit, then we’ll be entering a new era of housing affordability.

Property is still one of the most stable investments

Below is a graph we’ve shown on the blog before and unfortunately hasn’t been updated to include recent years, but you get a general sense of how the market responds to crises.

The share market over the same period has seen much more volatility with the All Ords dropping as much as -55% in a single year (yep, that was during the GFC). Though you might hear people telling you how much they’d have today if they invested $1 back in 1900, it also depends on how easy it is for you to liquidate your assets should you need to. If shares are in free fall, then it’s going to be pretty tough to divest yourself at any given time.

Property doesn’t grow exponentially like the share market seems to, but your investment is likely going to be a lot more stable and though the market takes modest dips, you will not likely ever see your property value decrease by over half at any point in time. At the end of the day, people are always going to need somewhere to live – and we’re sure you’ve heard it said before… “it’s safe as houses”.

Overall the statistics demonstrate a great deal about the strength of the property market. The general outlook has always been positive as people see the potential of property beyond immediate or physical presentation and also national economic circumstances. In times of recession, people still bought property… and a lot of it. It also demonstrates that land is historically and continuously king. That small weatherboard itself might not be worth much, but the land upon which it sits is not going anywhere.